Is the Sterndrive at the End of its Product Life?

The boating industry has relied on small evolutionary changes to justify the higher cost of new boats. This has been a losing struggle. Sterndrive boat sales, the heart of the industry, have dropped to 20% of their 1996 levels and are recovering poorly, even with the improving economy.

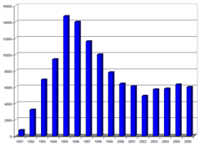

Example of disruptive innovation in an otherwise flat mature boat market. This is the SportJet boat segment, starting in 1991.

Innovative Propulsion Fuels Sales Booms

Historically, the industry’s sales booms have been fueled by disruptive propulsion innovations, like outboards, sterndrives, and jets. These innovations enabled boats with new features and benefits to meet the unsatisfied needs of consumers.

For example, look at how the market has rewarded disruptive innovations in an otherwise flat mature market. This is the SportJet-boat segment, starting in 1991.

Consumer Demand The opportunity is now available to do this again on a larger scale. JD Power surveys have long shown unsatisfied demands for improved performance, fuel-economy, operating costs, safety, and ease of operation, which have not been met by the industry’s evolutionary innovations. Commercial markets are looking for better sustainability and reduced operating costs.

The Basis for New Products – IntelliJet uniquely meets these demands by incorporating electronic control of power transmission and other methods commonly used in aircraft and autos. Like the SportJet, IntelliJet is the basis for new products with much more consumer value than used boats or conventional new boats.

With the economy rising out of the recession, this IntelliJet disruptive innovation is poised to enable the sale of a lot of motors and boats. Remember that sterndrive boat sales peaked at 150,000 in a pattern similar to the one above six years after the end of the last big recession of 1982.

This is a concrete example of an immediate opportunity to innovate.